Your customers expect their payment experiences to be simple, secure, and consistent, whether they’re buying online, on their devices, or in store. They also want to pay the way that best suits them. Customers are increasingly adopting alternative payment methods, such as eChecks and digital wallets.

However, all that choice has made the payment environment increasingly complex. That’s where tokenization can help simplify payments for your business. In fact, it’s already part of the payment security strategy for many businesses with an e-commerce channel – helping keep data secure.

But tokenization can also help you create a seamless payment experience, across channels and payment types, to keep customers coming back.

The evolution of payment tokenization

Almost 20 years ago, sellers, acquirers, and payment platforms started issuing tokens for individual payment credentials with the primary aim of keeping those credentials secure. A customer’s sensitive payment data is replaced with a digital identifier, or token, while the real data is securely stored. Even if the token is compromised, it can’t be reverse engineered to reveal the payment data.

The next iteration was network tokens, generated by payment networks like Visa. Instead of replacing a single primary account number (PAN) for its lifespan, a network token represents a customer’s payment credentials for all subsequent transactions. Even if a customer replaces their card, the credentials are automatically updated via lifecycle management. Customers can be recognized by their network token, allowing you to gain a better understanding of buying behaviors across different channels.

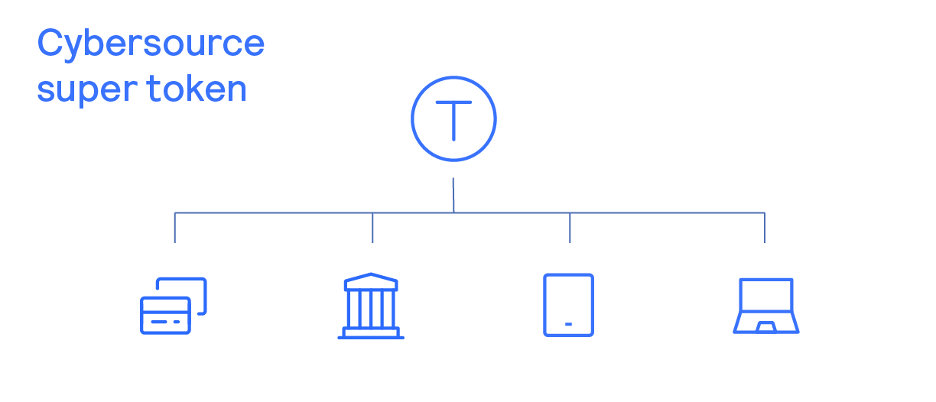

Now Cybersource goes further with its unique super token – the power behind our Token Management Service. Our proprietary super token links together network tokens from different card brands, banks, payment types, and channels.

Cybersource

How super tokens help increase customer loyalty

By linking previously disparate network tokens and payment types together, Cybersource’s super token centralizes and simplifies token management and connects and unifies customer payment data. This allows you to create a complete transaction history for each of your customers, as well as:

- Deliver simple, seamless payment experiences, no matter how your customers are shopping.

- Offer personalized loyalty, reward, and promotional opportunities for every online, mobile, and in-store transaction.

Making payments seamless and personalizing customers’ interactions with your brand can enhance loyalty – and drive repeat business that boosts revenue. You also get peace of mind that you’re keeping payment credentials safe and refreshed and reducing your Payment Card Industry Data Security Standard (PCI DSS) compliance scope.

To learn more about how payment tokenization can boost customer loyalty, download our guide.

IT Leadership

Read More from This Article: Increase Customer Loyalty with Payment Tokenization

Source: News