The financial services industry (FSI) today is poised for disruption. According to IDC, changes in consumer behaviour arising from the global pandemic, consumer perceptions, technological innovation and an inclination towards ‘everything digital’ are expected to drive rapidly accelerating transformation in the sector. There is also a fast-growing push towards green solutions and sustainable finance, from legislative and regulatory requirements as well as investor and consumer sentiments.

In response to these changes, significant new trends are gaining ground within the industry. Organisations are increasing their use of cloud, digital technologies, and artificial intelligence (AI) to develop innovative new solutions for customer experience and personalisation, analytics, and payments, among others. Adoption of these technologies is, in turn, evolving financial services’ customer experience (CX), enabling it to move from physical interactions to digital yet personalised experiences, while customer relationships shift from transactional to engagement-focused relationships that benefit from end-to-end, consistent cross-channel customer services.

As the FSI sector approaches a tipping point in digital transformation, organisations will need to undertake key changes to stay relevant and competitive in this fast-moving landscape.

Six changes to make finance smarter and greener

Speaking at MWC 2023, Jason Cao, CEO, Global Digital Finance, Huawei, described six changes that have the greatest potential to “accelerate changes and drive innovation” within the FSI sector.

Accelerating the Shift from Transactions to Digital Engagements

Business models must shift from a mindset of serving on-demand transactional needs through ‘financial’-centric applications, toward digital engagement via ‘lifestyle’-centric, daily apps.

Take one of the largest commercial banks in Thailand as an example. It deployed a lifestyle super-app alongside its existing financial super-app in a ‘platform + ecosystem’ model, which resulted in growing the 16 million transaction-focused users to 200 million customers across the region. Many are new-to-bank, enjoying a high degree of engagement as they use the super-apps on a daily basis. We see a similar success in Myanmar, where one of the country’s largest banks launched its mobile payment super app in 2018. By 2021, there were nine million app users, with 310,000 merchants and 45,000 agents benefitting from the app’s mobile payment system.

Accelerating the Transition of Core Banking Functions to Cloud Native

The successes among the Southeast Asian banks conversely highlight a challenge for digital infrastructure: rapid growth of customer base and transaction volumes demand rapid scalability. Applications need to be modernised, and core systems and data migrated to cloud native to be ready for these requirements.

In 2022, Postal Savings Bank of China (PSBC), a bank with 650 million retail customers, transitioned from a monolithic core banking system to a cloud-native architecture using Huawei’s cloud and GaussDB. The new system easily handles over two billion daily transactions, with up to 55,000 transactions per second at peak. An Indonesian bank also built its cloud-native digital banking system to achieve scalability for ten times its existing customer base. As Cao noted, the bank’s customers “grew by 1,000 times in three years” on their cloud-native infrastructure.

Accelerating infrastructure evolution to “MEGA”

As infrastructure evolves, the respective advantages of cloud, storage, computing, network and optical systems can be integrated and optimised as a system. Huawei approaches this through the MEGA framework, combining multi-domain (cloud-network) collaboration, user experience, Green ICT infrastructure and an intelligent autonomous driving network. This infrastructure framework offers rapid cross-vendor configuration, low-latency and end-to-end automation capabilities, while reducing energy consumption by up to 80% per TB.

Technology is transforming finance in many ways, presenting more opportunities for both financial institutions and consumers

Huawei

Accelerating democratisation of data analytics and AI

Organisations in FSI are increasingly applying data analytics and AI in marketing, fraud detection, credit scoring, and operations. Data and AI have enabled institutions such as China Merchants Bank (CMB) to protect 3.2 billion transactions since 2016, while another major commercial bank in Shanghai is able to detect abnormalities in financial events with 99.99% accuracy. AI is also driving higher conversion rates through improved interactions and reducing mean time-to-resolution for customer queries.

Accelerating real-time data analysis to unleash data value

China Merchant Bank (CMB), a leading retail bank with assets under management of over 10 trillion yuan, practices a ‘data for everyone’ strategy. The transition from T+1 to T+0 real-time data import, multi-tenant data warehouses, and elastic scalability are the basis of the strategy. Over 40% of the company’s employees are active users on the bank’s analysis platform. As a result of this quick and convenient access to data and analytics, real-time decision making, and real-time risk control within 20ms can be realised.

Accelerating toward a cutting-edge AI brain

“ChatGPT has shown the feasibility of generative AI applications,” highlighted Cao, “and everyone can use it,” further raising the bar for in-depth, accessible AI applications. One of China’s largest banks has, since 2017, been steadily building up their AI capability. Today the bank’s AI brain can serve over 1,000 scenarios and provide over 10 million intelligent services.

Powering digitalisation through innovation

A deeply embedded culture of Research and Development (R&D) is the key to innovation. According to Cao, “innovation is in Huawei’s DNA,” with over half of the company’s employees being R&D employees, and more than 10% of revenue is spent on R&D. In 2021 alone, US$22.4 billion was deployed for R&D, representing 22% of annual revenue. David Wang, President of the Enterprise BG, Huawei, stated the company will “continue to lead innovation in digital infrastructure, and adapt technologies to different scenarios.”

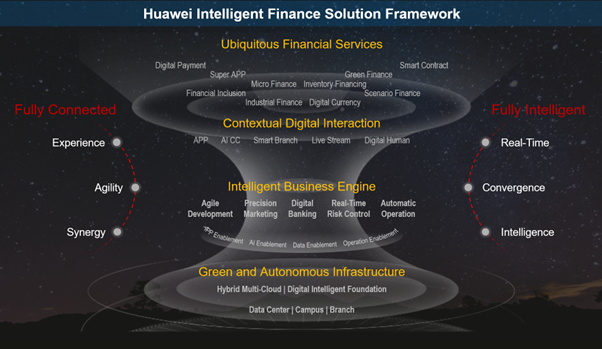

Huawei Intelligent Finance Solution Framework provides green and autonomous infrastructure, intelligent business engine, and super App platform for digital interaction and scenario innovation.

Huawei

This consistent investment in innovation has made Huawei a key technology partner for global FSI institutions. The company counts more than 2,500 financial institutions from more than 60 countries as customers, including 50 of the world’s top 100 banks. Huawei also works with over 150 global partners to develop solutions and provide comprehensive services to their customers.

By working closely with partners and customers across the world, the company aspires to Shape Smarter, Greener Finance Together. Huawei will be hosting its 11th Huawei Intelligent Finance Summit in early June to unveil and showcase more innovations.

Learn more about Huawei’s approach to Intelligent Finance here.

Cloud Native

Read More from This Article: Huawei: Transition to cloud native and democratisation of AI among changes needed for smarter, greener finance

Source: News