The make-versus-buy decision at the heart of any outsourcing proposition is not as black-and-white as many IT leaders think.

Keeping IT work insourced versus contracting with a partner organization no longer needs to be a yes or no decision. Over the past two decades, progressive sourcing models have emerged to enable companies to work more strategically with suppliers in a way that creates value and drives innovation. But to do so, IT leaders must move beyond a transactional mindset when it comes to outsourcing partnerships, as far too many fall into a classic catch-22 of wanting a strategic outsourcing solution while implementing a transactional contract.

This catch-22 comes into play because companies using conventional sourcing and contracting methods find their service providers are meeting contractual obligations — but they are not driving innovations and efficiencies at the pace they would like to see. Suppliers argue that investing in their customers’ business is risky because buyers simply take their ideas and competitively bid on the work. Companies want solutions to close the gaps but do not want to invest in people, processes, and technology where they do not have a core competency. The result is that IT organizations are at a crossroads, with both buyers and service providers wanting innovation — but neither wanting to make the investment due to the conventional transaction-based commercial structure of how the companies work together.

But there is another way.

Sourcing as a continuum, not a destination

Academic research offers insight into this dilemma. The University of California’s Dr. Oliver E. Williamson (1932-2020) challenged the traditional make-versus-buy view with his work in Transaction Cost Economics. Recognizing this catch-22, Williamson advocated for a third “hybrid approach” as the preferred method for dealing with complex services where there is a high level of dependency. In such a scenario, the market cannot be used to switch suppliers freely, and an insourced solution may not be a good fit. Williamson suggested companies seek approaches with suppliers to create more strategic and longer-term relationships to balance the weaknesses found in a pure market-based or pure insource-based approach. Williamson received the Nobel Prize for his work in 2009.

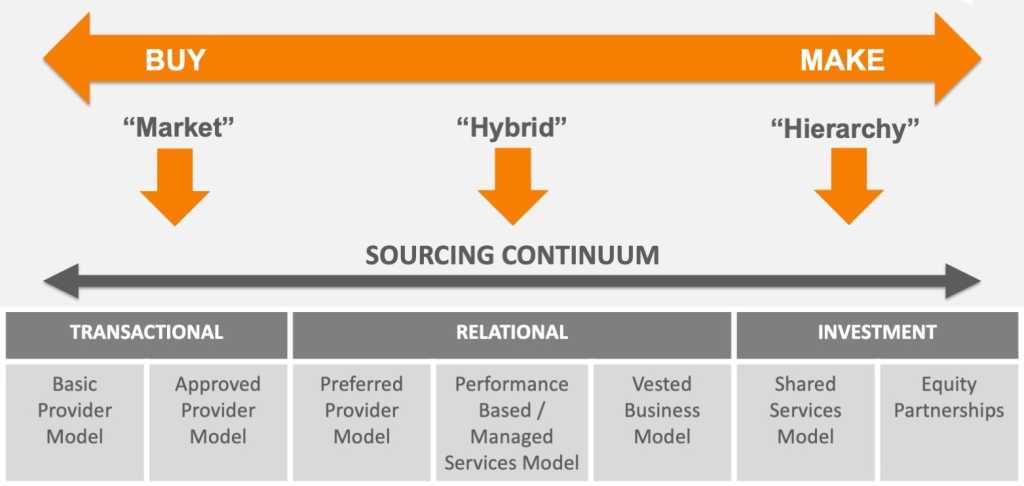

Our work at the University of Tennessee (UT) evolved the concept of using hybrid approaches into what we have coined Sourcing Business Model Theory, which suggests sourcing should be thought of as a business model between two parties with the goal of optimizing the exchange. Figure 1 aligns seven sourcing businesses to Williamson’s economic theory.

Figure 1: Sourcing business model continuum

University of Tennessee Haslam College of Business Administration

Two models (on the left) align with what Williamson refers to as “the market,” while two models (on the right) align with what Williamson coined as “corporate hierarchies.” In the middle, three models align with the hybrid approach for complex contracts for which Williamson advocated. These demand flexibility, continuous improvement, and investment in innovation. The key to optimizing your outsourcing relationship is picking the most appropriate sourcing business model for your situation — and architecting the deal points appropriately.

Selecting the right sourcing model

To pick the right model for your venture, it’s imperative to know the economic basis of each sourcing business model and the kinds of situations for which each fares best. Here is a breakdown of each model along the sourcing continuum.

The Basic Provider Model is transaction-based, offering a set price for individual products and services for which there is a wide range of standard market options. This model should be used only to buy low-cost, standardized goods and services in a market with many suppliers.

The Approved Provider Model is also transaction-based, but here, goods and services are purchased from suppliers that meet a pre-defined set of qualification characteristics — quality standards, proven performance, or other selection criteria. Organizations using this model establish a limited number of pre-approved suppliers from which buyers or business units can choose. If one supplier is not performing, you can easily replace them with another.

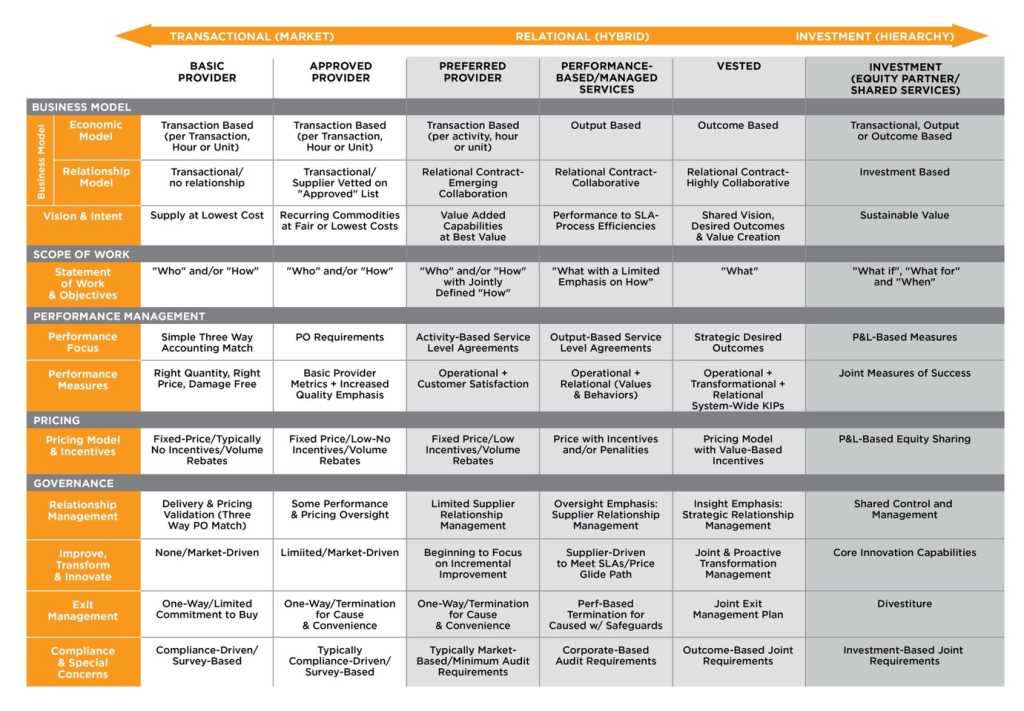

As organizations shift up the sourcing continuum, a key differentiator to success is consciously choosing to build stronger and deeper relationships with suppliers. Unfortunately, here is where far too many organizations get it wrong. They begin to say “strategic partner” and “innovation” yet fail to invest in rethinking their transactional approaches, thereby falling into the catch-22. To escape this trap, it is important to architect the commercial aspects of your outsourcing deal to align with the nature of the sourcing business model (see Figure 2 below for a cheat sheet on architecting the commercial structure for each model).

The first stop along a more relational approach is a Preferred Provider Model. IT organizations seeking to do business with a preferred provider often enter into multi-year contracts using a master services agreement that allows them to conduct repeat business efficiently. The model still uses transactional economics, but how the parties work together and achieve efficiencies goes beyond the simple purchase order.

A Performance-Based Model (or Managed Services Model) embeds this strategic mentality in an even longer-term agreement. When structured well, this model shifts to a relational contracting approach with an output-based economic model. Performance-based agreements move away from activities to predefined “outcomes” that are well-defined achievements of an event or deliverable typically finite in nature and easily understood. A good example is a supplier’s ability to achieve pre-defined service level agreements (SLAs) or to meet a savings glide path.

A Vested Sourcing Business Model is highly collaborative, with both buyer and supplier havingan economic interest in each other’s success. Such “win-win” arrangements are designed to create value for both parties beyond the conventional buy-sell economics of transaction-based or performance-based agreements. The model combines an outcome-based economic model with behavioral economics and the principles of shared value. A vested model works best for transformational or innovation objectives that a company cannot achieve itself or by using conventional transactional models.

On the far right of the continuum are the insource options, which require a company to consciously invest in internal operations instead of working with suppliers. With a Shared Services Model, processes are centralized into a “shared service” organization that charges members for services used. It is possible to employ this model and still outsource parts of the work under a market-based or hybrid-based model.

Equity Partnerships include a variety of solutions, such as a joint venture, acquisition, or investing in a subsidiary. Investment-based solutions should be considered only when an organization does not have adequate internal capabilities to acquire mission-critical goods and services but does not want to outsource or invest in a shared services organization. Equity partnerships create a legally binding entity and as such offer the least amount of flexibility to change or exit the relationships that are involved in the equity partnership.

Alignment is key

One of the most common traps in sourcing IT services today is for IT leaders and their procurement departments to be misaligned. If you are saying “strategic partner,” “innovation,” and “outcomes,” and the procurement is using the wrong sourcing model, you will likely get what the sourcing team bought and the legal team contracted for. Simply put, it will be akin to putting a square peg in a round hole.

Equally important — and harder to get right — is to architect the commercial aspects of the relationship properly. For this, we suggest using Figure 2 below. For a deeper dive, read the book Strategic Sourcing in the New Economy: Harnessing the Potential of Sourcing Business Models for Modern Procurement. The University of Tennessee also offers a free online course to help you determine which Sourcing Business Model best fits your situation. (Disclosure: I am a professor at the University of Tennessee and the book’s co-author.)

The bottom line? It’s your bottom line. Organizations that fail to use the appropriate sourcing model are likely to find themselves in either a classic catch-22 outsourcing trap or, at a minimum, adding unnecessary transaction costs from a poorly architected outsourcing agreement.

Figure 2: Business model cheat sheet

University of Tennessee Haslam College of Business Administration

Outsourcing

Read More from This Article: Avoiding the catch-22 of IT outsourcing

Source: News